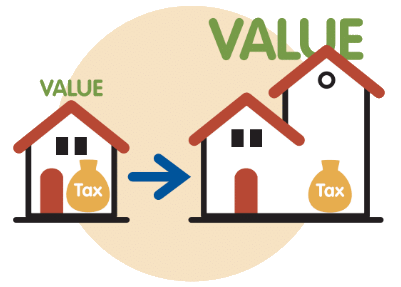

If you are over 55 you need to know how Prop 19’s passage in November might affect you. Basically, according to new property tax rules, Prop 19 allows you to move the current property tax on your home to any new home you purchase in the State of California. For example, homeowners who wanted to move closer to their family near Lake Tahoe have real problems in the past. Previously 50 out of 58 California Counties, including those around the Lake, would not allow you to move your tax basis to a home in those areas. Now you can.

Before Prop 19 passed, the old rules forced you to purchase a less expensive home in order to move your current taxes to the new home. That has been repealed. You may now purchase a more expensive home and take your old lower taxes with you. This gives you the freedom to move and keep your currently low taxes.

If a few years ago you bought a Montecito home for $1,000,000 you paid about $10,000 in annual property taxes. It may now be worth $3M. In the past if you then purchased a new home for $4M your taxes would be $40,000 per year – a $30,000 increase. That prevented some people from moving.

Here’s how the new rules could work to save you most of that tax increase. If we use the same example with the new rules, your taxes would only increase $10,000 instead of going up $30,000. This will make your move more affordable.

It is important to note that this goes into effect April 1, 2021, so this will not apply to any escrow that closes before April 2, 2021. In addition, there are more details that are helpful to know. I can discuss these with you when you give me a call. This is a great time to be planning your move if you want to take advantage of Prop 19.

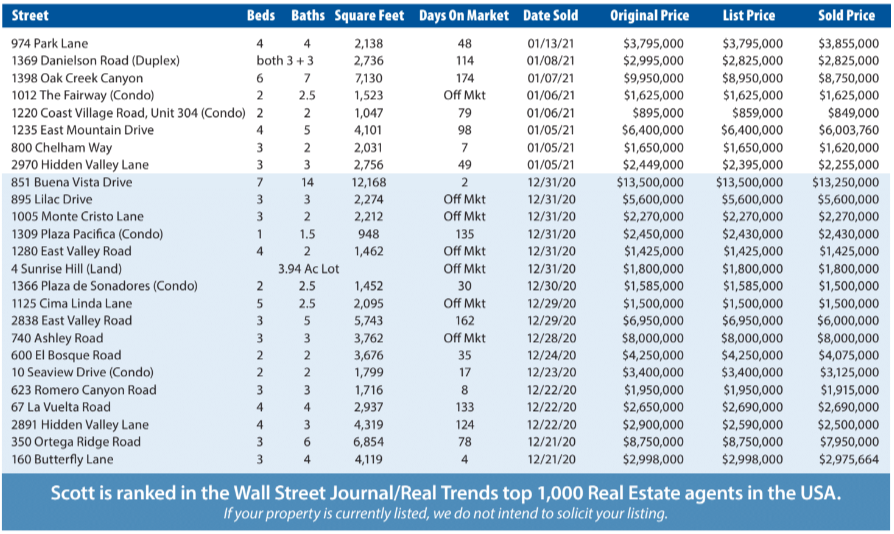

Montecito Market Report

City Now Allows Removal of ADU Covenants

Several hundred homeowners in the City who built an Accessory Dwelling Unit (ADU) between 2017 and 2019 found themselves with a problem with the City of Santa Barbara. When they got the ADU approval, the City forced them to sign a Covenant requiring that the owner occupy one of the two units. Subsequently, the state disallowed this practice, but the City maintained that those who signed in the past would have to honor their agreement.

Many people called me who had this problem. They found that it would be expensive to sue the City with no certainty of success. The Association of Realtors took up their case and successfully negotiated for months with the City to get this covenant removed. The rules are slightly different for Junior ADU’s.

If you want to get the Covenant removed, you will need to supply the City with an application and pay $457 in fees. Feel free to call me if you want to know more.